Introduction

Are you ready to join the investment scene in Kenya but aren’t sure where to start? Don’t worry, you’re in the right place.

What is investing? It’s simply the process of putting money into financial assets with the expectation of generating a return or earning income over time.

Investing is not gambling. It’s about making informed, calculated decisions based on research and analysis. It can feel intimidating, whether you’re a beginner or an experienced investor, but it doesn’t have to be. Investing, when done correctly, is a fun and exciting journey that will help you achieve your financial goals. Think of investing as part of your lifestyle, whether you take an active role or prefer a more passive approach—it should be woven into your everyday life.

Investing is not a get-rich-quick scheme. If someone promises instant success, they’re likely benefiting from your investment and oversimplifying the process. Building wealth through investing is a slow and steady process that requires commitment and time.

Investing has often been viewed as a complicated game reserved for financial experts, but this isn’t true. You don’t need to be a finance guru or understand complex jargon to start investing. This guide aims to provide you with the absolute basics you need to begin your investment journey in Kenya. It’s not about getting rich fast—it’s about gradually building wealth in an informed, thoughtful way.

The fear of losing money is natural. It’s ingrained in our psyche. In fact, we tend to focus more on avoiding losses than pursuing gains, a concept known as loss aversion. But understanding investing helps diminish that fear. The more you learn, the more confident you’ll become.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Benjamin Graham

Patience and discipline are essential for successful investing. Let’s dive into the key points to get started.

Why Invest?

Everyone has different reasons to invest, but they usually fall into these four main categories:

- Financial Security: Investing helps protect and grow your savings, which is crucial in a country like Kenya where inflation can reduce the value of money over time. It’s about making sure your money isn’t just sitting idle in a bank account, losing purchasing power.

- Financial Independence: Investing gives you the opportunity to eventually rely on your investments as a source of income, reducing your dependency on a paycheck.

- Building Wealth: Over time, investments compound and generate more returns, allowing you to build a solid financial foundation.

- Attaining Goals: Whether it’s saving for a house, car, education, debt repayment, holiday or retirement, investing accelerates your ability to achieve these life goals.

Different Investment Options in Kenya

Now that you know why investing is important, let’s look at six investment options that are ideal for beginners in Kenya.

1. Money Market Funds (MMFs)

Money Market Funds are a type of mutual fund that invests in low-risk, highly liquid short-term debt instruments such as Treasury bills and commercial paper. They’re perfect for capital preservation while earning modest returns.

- Benefits: Low risk, high liquidity, better returns than traditional savings accounts.

- Risks: Limited growth potential and subject to inflation risk.

- Costs: Management fees (0.1%-0.5%) and a withholding tax of 15% on the interest earned.

2. Exchange-Traded Funds (ETFs)

ETFs hold a basket of assets like stocks, bonds, or commodities and are traded on stock exchanges like individual stocks. They offer diversification and are perfect for beginner investors.

- Benefits: Low fees, diversification, and liquidity.

- Risks: Market risk (value fluctuates with the assets), liquidity risk for less traded ETFs.

- Costs: Management fees (0.1%-0.75%) and brokerage commissions when buying and selling.

3. Treasury Bills (T-Bills)

T-Bills are short-term government debt instruments. They mature in less than a year and are considered virtually risk-free as they’re backed by the government.

- Benefits: Virtually risk-free and highly liquid.

- Risks: Lower returns compared to other long-term investments, inflation risk.

- Costs: Minimal transaction fees if purchased directly from the government.

4. Stocks

Stocks represent ownership in a company. By investing in local stocks such as Safaricom or Equity Bank, you can earn returns through price appreciation and dividends.

- Benefits: High returns and dividend income.

- Risks: Market volatility, potential for losses if the company underperforms.

- Costs: Brokerage fees (1.5%-2.5% per transaction), capital gains tax (5%).

5. Bonds

Bonds are fixed-income securities where you lend money to a government or corporation in exchange for periodic interest payments and repayment of the principal at maturity.

- Benefits: Predictable income stream and lower risk than stocks.

- Risks: Interest rate risk (bond prices fall when rates rise), credit risk for corporate bonds.

- Costs: Lower brokerage fees than stocks.

6. SACCOs (Savings and Credit Cooperatives)

SACCOs allow members to pool their resources, save, and lend to each other. They offer dividends on share capital and low-interest loans based on savings.

- Benefits: Higher interest rates on savings and low-interest loans.

- Risks: Limited liquidity, risk of poor management affecting dividends.

- Costs: Membership fees, regular savings contributions, and low loan fees.

Setting Investment Goals

Goal setting is critical to achieving success in investing. You should never invest without clear goals in mind. Some common objectives include capital preservation, capital growth, generating cash flow, and improving your lifestyle.

Before setting goals, assess your circumstances by considering your age, career, lifestyle, and risk appetite. Once you understand where you stand, your goals should be SMART: Specific, Measurable, Achievable, Realistic, and Time-bound.

Steps to Setting Investment Goals:

- Review Your Finances: Understand your current financial situation.

- Divide Goals into Short, Medium, and Long-Term: This helps you decide which investments are best suited for each goal.

- Prioritize Your Goals: Decide what’s most important to achieve first.

- Determine How to Achieve Them: Plan out your investment strategy.

- Monitor Your Progress: Regularly check in on your investments to make sure you’re on track.

- Revisit and Adjust Goals: Life changes, and so should your goals.

Understanding Risk and Return

Two critical concepts in investing are risk and return. Risk is the chance of losing money, while return is the potential reward for taking that risk.

- Higher risk usually comes with higher potential returns, but also a greater chance of loss.

- Risk tolerance depends on your time horizon, financial stability, and how comfortable you are with potential losses.

There are two main types of risk:

- Systematic Risk (Market Risk): Affects the entire market and can’t be avoided.

- Unsystematic Risk (Specific Risk): Related to individual companies and can be mitigated through diversification.

To manage risk, it’s essential to diversify—spread your money across different types of investments.

Start Small

One of the biggest myths about investing is that you need a lot of money to start. This isn’t true. Many investment options in Kenya allow you to start with as little as KES 1,000. The key is to start small and stay consistent.

Example: If you invest KES 5,000 in a Money Market Fund with a 10% annual return, your investment will grow over time, especially if you reinvest your earnings. This approach allows you to take advantage of compounding—the process where your returns generate more returns.

Building a Beginner’s Investment Portfolio

Building an investment portfolio can be an enjoyable adventure, yet it is essential to strike the right mix of growth opportunities, risks, diversification, and liquidity. Through these four factors, you can manage the portfolio so that the potential for increasing your wealth grows steadily without putting yourself at unnecessary risk. Let’s examine these factors, what they entail, and their significance in practice.

Growth Potential

This refers to the value added to one’s investments, projecting their future value. Asset classes like equities (stocks) and ETFs have significant growth potential. However, they are subject to greater risks.

Risks

Whenever money is put into any investment, it is always subject to risk. The key is to complement high-risk investments such as stocks with low-risk counterparts like bonds or Money Market Funds (MMFs).

Portfolio Risk Management

Here, you spread your investment funds into various types of assets and investments to reduce risk. If one type of investment performs poorly, another may perform better and help balance the total outcome. This is called diversification.

Liquidity

Liquidity is concerned with the time and ease of turning an investment into cash. For example, Money Market Funds and stocks can be converted more quickly into cash than real estate or long-term bonds.

By considering these factors, it is possible to create a simple investment portfolio for a beginner that matches their targets and the level of risk they are willing to take.

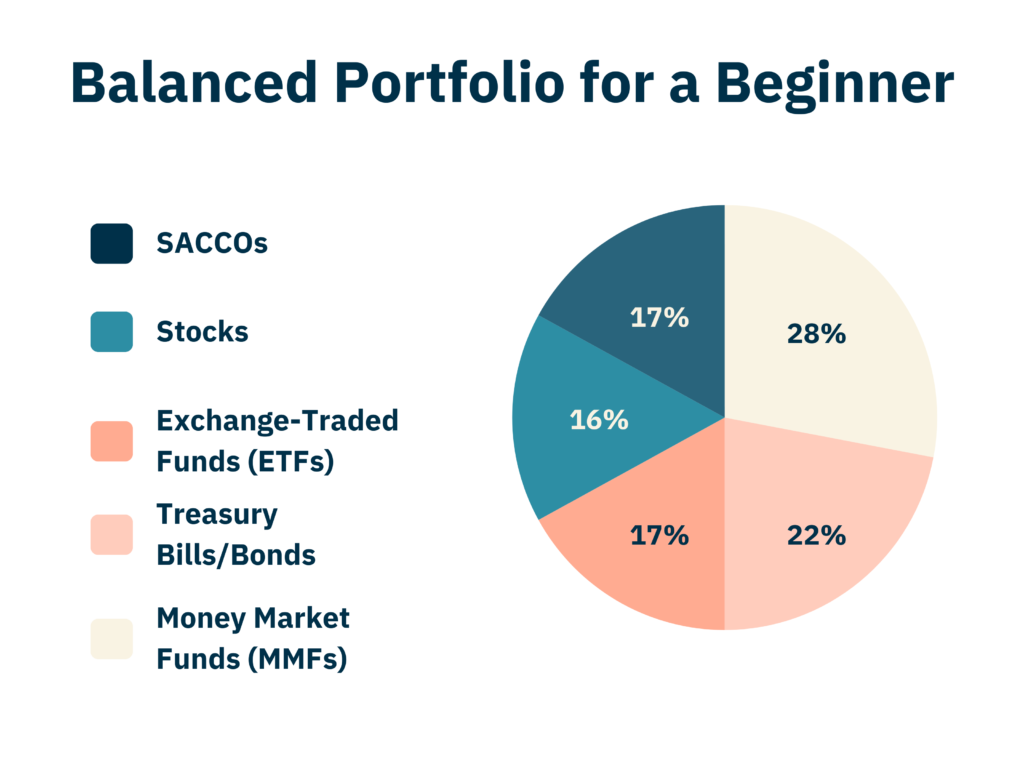

Suggested Balanced Portfolio for a Beginner

A beginner may consider distributing the portfolio along these lines to achieve a balanced portfolio relative to risk:

- 28% in Money Market Funds (MMFs): These are low-risk investments and allow quick, easy access to funds, making them an ideal foundation for any portfolio.

- 22% in Treasury Bills/Bonds: These are government-backed securities that yield income consistently, providing assurance in the returns offered to the investor.

- 17% in Exchange-Traded Funds (ETFs): ETFs buy a variety of stocks, bonds, or commodities within one investment, reducing exposure to risk while offering diversification.

- 16% in Stocks (Equities): Stocks have high potential for growth but bring higher chances of sharp price fluctuations. By allocating some percentage to stocks, you make it possible for the portfolio to appreciate in value while managing the risks.

- 17% in SACCOs: SACCOs are societies that pool savings and investments, paying dividends and providing options for loans, making them a prudent long-term investment strategy to guarantee safety.

This balanced strategy ensures that the acquired or built-up investment portfolio is healthy for growth, retains stability, and remains liquid. It further reduces the exposure to unrelated assets such as equities while still ensuring the portfolio develops over time.

Why This Portfolio Works for Beginners

Low Risk and Steady Returns

Seasons are common phenomena in business. If it’s not operational income that affects a business, there is always uncertainty during times of recession or transitions to other financial instruments.

Growth Opportunities

Similar to the local stock market, this long-term risk strategy also includes investing in stocks and exchange-traded funds. SACCOs, on the other hand, focus on local investments by supporting savings and offering returns.

Diversification

The portfolio combines cash equivalents from MMFs, fixed income from bonds, equities from stocks and ETFs, and alternative savings from SACCOs, minimizing the risk of concentrating resources into one investment area.

Liquidity

MMFs, stocks, and ETFs offer liquidity, meaning some of the investments made can be converted into cash on short notice if needed. This arrangement enables you to harness growth according to your risk appetite, broaden your investments, and keep enough liquidity to meet financial obligations.

One-Year Return Example for KES 1,000,000 Portfolio

| Investment Type | Portfolio Percentage | Amount Invested (KES) | Estimated Return (%) | Return After One Year (KES) |

| Money Market Funds (MMFs) | 28% | 280,000 | 12.5 | 35,000 |

| Treasury Bills/Bonds | 22% | 220,000 | 10 | 22,000 |

| Exchange-Traded Funds (ETFs) | 17% | 170,000 | 12 | 20,400 |

| Stocks | 16% | 160,000 | 15 | 24,000 |

| SACCOs | 17% | 170,000 | 10 | 17,000 |

| Total | 100% | 1,000,000 | 118,400 |

Conclusion

Investing is not reserved for experts or the wealthy. Whether you’re starting small with a Money Market Fund, buying your first stock, or saving through a SACCO, the key is to start. Investing is a journey that requires patience, discipline, and learning as you go. The earlier you start, the more time you give your money to grow, and the closer you get to achieving your financial goals.

Now that you have the basics, take that first step—whether it’s setting up a Money Market Fund or buying your first stock. Remember, the most important thing is to get started, even if it’s with a small amount. Over time, your investments will grow, and you’ll be well on your way to financial security and independence.

I’ve learned so much about investing from your post. Your insights are incredibly clear and practical, and they’ve really helped me understand the basics of investing. Thank you for sharing your knowledge and making these concepts so accessible! Keep up the amazing work!