Analyzing Key Indicators and Growth Drivers

Introduction

Kenya’s economy entered 2024 with cautious optimism. Despite lingering global uncertainties, the country showed resilience, driven by key sectors like agriculture, financial services, and tourism. The first quarter provided a critical foundation, reflecting both the progress and challenges that have characterized Kenya’s economic trajectory. The lessons learned in Q1 offer vital insights into how the rest of the year may unfold.

This detailed review will dissect Kenya’s economic performance in Q1 2024, focusing on the key growth drivers such as agriculture and services, and analyzing how inflation trends, monetary policy adjustments, and external factors shaped the economy. We’ll explore how the country has fared in terms of inflation control, GDP growth, and sectoral performance, providing a comprehensive view of the current economic climate.

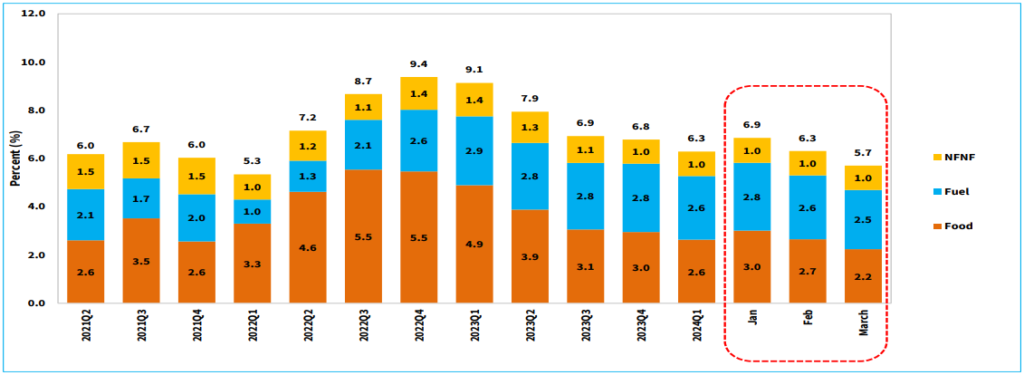

1. Inflation Trends and Their Impact

Inflation Overview

One of the significant economic developments in Q1 2024 was the slight easing of inflation, which had been a persistent challenge in the previous year. Inflation dropped from 6.8% in Q4 2023 to 6.3% in the first quarter of 2024. Although this decline is modest, it marked a positive trend, providing relief for consumers, particularly in urban areas where the cost of living had been escalating rapidly.

Food Inflation

Kenya’s food inflation has been a key driver of overall inflation, given the large portion of household budgets that are spent on food. In Q1 2024, food inflation eased considerably, thanks to favorable weather conditions and improved agricultural output. The country experienced a bumper harvest in staple crops like maize, wheat, and sugarcane. Sugar prices, which had soared in 2023 due to both domestic shortages and global market pressures, began to decline, falling by 7.5% by the end of March 2024.

Another factor contributing to lower food prices was the government’s subsidy program for fertilizers and seeds, which had been rolled out in late 2023. The program helped farmers reduce production costs, thereby allowing them to bring more products to market at lower prices. This intervention was particularly impactful in reducing the prices of maize and milk, two staple foods that have a significant weight in Kenya’s inflation basket.

Despite these gains, the agricultural sector remains highly vulnerable to external factors such as global food prices and climate change. Periods of drought or excessive rainfall could quickly reverse these gains, underscoring the need for long-term strategies to build resilience in food production.

Fuel Inflation

Fuel prices, a major contributor to inflationary pressures in 2023, also began to stabilize in early 2024. The global oil market experienced some recovery, leading to a 3.2% decline in global crude oil prices. This, combined with the Energy and Petroleum Regulatory Authority’s (EPRA) decision to lower pump prices, helped reduce transportation and production costs across various sectors.

However, it is important to note that while the downward adjustment in fuel prices eased inflationary pressures, Kenya remains highly dependent on imported fuel. Global supply chain disruptions or geopolitical tensions in oil-producing regions could quickly trigger price volatility. Additionally, the depreciation of the Kenyan shilling against major currencies, particularly the US dollar, continues to exert upward pressure on fuel prices in local currency terms.

Non-food, Non-fuel Inflation

While food and fuel prices eased, non-food, non-fuel inflation saw an increase, driven by higher costs in the education and healthcare sectors. The cost of education services rose by 5.3%, as schools and universities increased tuition fees to cover rising operational costs. In the healthcare sector, the prices of both medical services and pharmaceuticals increased due to higher input costs and supply chain challenges.

This upward trend in non-food, non-fuel inflation signals that while inflation may be easing in key sectors, certain costs continue to rise, putting pressure on households, especially in urban areas where healthcare and education costs represent a significant portion of household spending.

Implications

The slight decline in inflation during Q1 2024 provided some breathing room for households and businesses, but the broader inflationary environment remains fragile. Sustaining this downward trend will require continued government interventions in food and energy markets, alongside efforts to stabilize global supply chains.

Kenya’s inflation trends also reflect the delicate balance policymakers must strike between managing inflation and supporting economic growth. Inflationary pressures in sectors like education and healthcare suggest that more targeted policies may be necessary to address the rising costs in non-food, non-fuel sectors.

The country’s ongoing vulnerability to global market shocks, particularly in food and fuel prices, highlights the need for greater diversification in both energy sources and agricultural production.

Chart 1.1: Contribution of Broad Categories to Overall Inflation

Source: KNBS and CBK

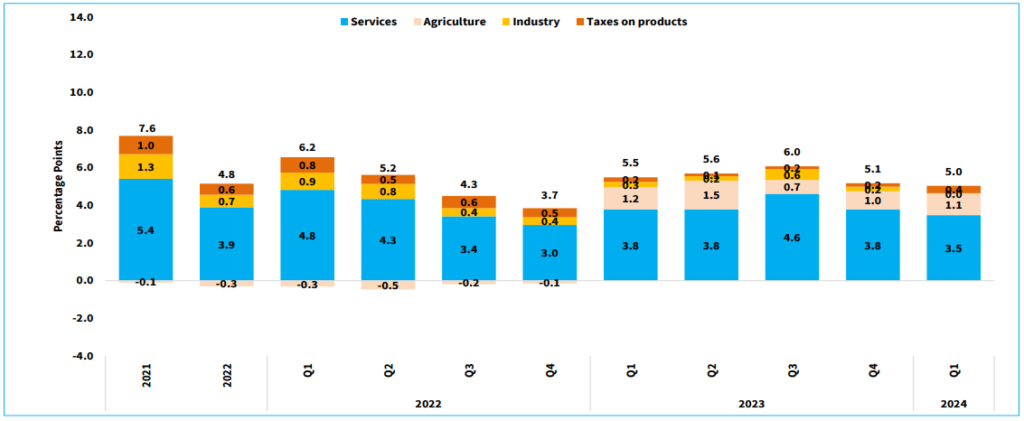

2. Economic Growth: Key Drivers in Agriculture and Services

Overview of Economic Growth

Kenya’s economy grew by 5.0% in Q1 2024, compared to 5.5% in the same period the previous year. This moderation in growth reflects the ongoing global economic challenges, including fluctuating commodity prices and supply chain disruptions. However, the economy’s resilience was evident in the strong performances of the agricultural and service sectors, both of which provided much-needed stability amid uncertainties in other areas.

Agriculture

Agriculture remains one of Kenya’s most crucial sectors, contributing approximately 22% of the country’s GDP. In Q1 2024, the sector grew by 6.1%, driven by favorable weather conditions and increased output in key crops like tea, maize, and horticultural products. The tea sector, in particular, saw a surge in production, buoyed by strong demand from European and Middle Eastern markets.

Kenya’s horticultural exports also performed well during the quarter, with flowers and fresh produce continuing to be in high demand internationally. The government’s efforts to streamline export processes and improve logistics have further boosted the competitiveness of Kenyan agricultural products in global markets.

However, despite these gains, agriculture remains vulnerable to the effects of climate change. Periods of drought or erratic rainfall could quickly disrupt food production, leading to supply shortages and price spikes. To mitigate these risks, the government has been exploring long-term solutions such as investing in irrigation infrastructure and climate-resilient crop varieties.

Service Sector

The service sector was another key driver of economic growth in Q1 2024, expanding by 6.2%. Kenya’s financial services and ICT industries were at the forefront of this growth, benefitting from the ongoing digital transformation and increasing adoption of mobile financial services. The government’s push to promote e-commerce and digital banking has further enhanced the sector’s performance.

One of the standout performers within the service sector was the retail industry, which experienced a surge in consumer spending, particularly in urban areas. The growth of mobile payment platforms like M-Pesa has revolutionized retail transactions, making it easier for consumers to access goods and services.

The tourism sector also saw a revival, with international arrivals increasing as global travel restrictions were lifted. Kenya’s strategic marketing campaigns, aimed at attracting tourists from Europe and North America, helped boost revenues in the hospitality and travel industries. The increase in tourist arrivals had a ripple effect on related sectors such as transportation, food services, and accommodation.

Industrial Sector

While agriculture and services drove much of the economic growth in Q1 2024, the industrial sector struggled to keep pace, growing by just 0.1%. Manufacturing output was dampened by rising input costs, supply chain disruptions, and reduced consumer demand for industrial goods. The construction industry also faced challenges, with delays in infrastructure projects and rising costs of building materials slowing down growth in the sector.

Implications

Kenya’s growth trajectory in Q1 2024 highlights the critical role of agriculture and services in driving economic expansion. However, the underperformance of the industrial sector remains a significant concern, particularly in light of the country’s long-term development goals, which emphasize industrialization and infrastructure development.

To sustain economic growth in the coming quarters, Kenya will need to focus on reviving its industrial sector. This could involve greater investment in manufacturing capabilities, improved access to affordable credit for businesses, and addressing supply chain disruptions that continue to hinder industrial output.

Chart 2.1: Sectoral Contributions to Real GDP Growth (Percentage points)

Source: KNBS and CBK

3. Developments in Money, Credit, and Interest Rates

Monetary Policy Adjustments

The Central Bank of Kenya (CBK) raised the Central Bank Rate (CBR) from 12.5% to 13% in Q1 2024, a move aimed at curbing inflationary pressures while stabilizing the economy. By increasing the CBR, the CBK sought to manage rising inflation expectations, particularly those driven by global commodity price fluctuations. The higher interest rate reflects the central bank’s broader strategy to cool down inflationary pressures without significantly stifling economic growth.

Money Supply and Liquidity Management

In tandem with raising interest rates, the money supply (M3) contracted by 5.3% during Q1. The appreciation of the Kenyan shilling against major currencies, combined with a decline in deposits, contributed to this contraction. The CBK’s actions were part of an effort to tighten liquidity in the market, reducing the amount of money in circulation, which can help to reduce inflation.

However, this tightening of liquidity may have unintended consequences for businesses and consumers who rely on credit for financing investments, operations, and consumption. A reduction in money supply can constrain access to affordable loans, which might stifle growth, especially in sectors like manufacturing and construction that are already underperforming.

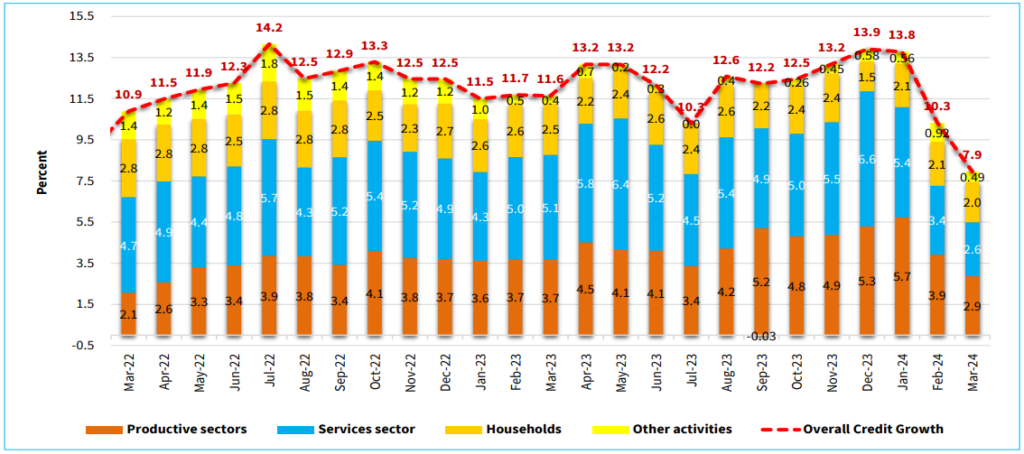

Private Sector Credit Growth

Despite the CBK’s efforts to tighten liquidity, private sector credit expanded by 11.5% in Q1 2024, showing continued demand for loans across various sectors. Borrowing increased particularly in trade, real estate, and finance. Businesses continued to seek credit for investment and operational needs, even as the cost of borrowing increased.

However, this expansion in private sector credit comes with risks. The non-performing loans (NPL) ratio rose to 15.7%, highlighting the growing financial pressure on businesses and consumers alike. The increase in NPLs signals that many borrowers are struggling to repay their debts, which poses a risk to Kenya’s banking system. If the NPL ratio continues to climb, it could lead to more stringent lending conditions and a potential credit crunch.

Implications

The CBK’s decision to raise interest rates while controlling liquidity reflects a delicate balancing act. On one hand, higher interest rates are necessary to control inflation and stabilize the economy; on the other hand, rising borrowing costs could hinder economic activity, particularly for small and medium-sized enterprises (SMEs) that depend on affordable credit. Policymakers will need to monitor the rising NPL ratio closely, as further increases could undermine financial stability and economic growth.

Chart 3.2: Contribution to Overall Credit Growth by Sector

Source: KNBS and CBK

4. Global Economic Context and Implications for Kenya

External Economic Environment

Kenya’s economy, like many others, is intricately linked to the global economy, and developments in international markets continued to influence Kenya’s economic performance in Q1 2024. The global economy is projected to grow by 3.2% in 2024, driven by recoveries in the United States and emerging markets. However, regional disparities remained, with Europe’s recovery lagging due to ongoing energy supply disruptions and geopolitical tensions.

Export Sector Performance

Kenya’s export sector performed relatively well in Q1, with horticulture and tea exports leading the way. Increased demand for Kenya’s agricultural products, especially in European and Middle Eastern markets, provided a boost to foreign exchange earnings, helping to narrow the country’s trade deficit.

Kenya’s horticultural exports—including flowers, fruits, and vegetables—have long been a key contributor to the country’s foreign exchange reserves. The strong demand for these products in Europe, combined with improved logistics and export processes, ensured that horticulture continued to perform well in Q1. Tea exports also benefited from strong demand in key markets, further stabilizing the country’s export revenues.

Tourism Recovery

Kenya’s tourism sector continued its recovery in early 2024, following the lifting of pandemic-related travel restrictions in 2023. International arrivals increased, with tourists from Europe and North America contributing to the growth in hospitality and travel services. Government-led marketing campaigns and improved aviation links to major tourist destinations like Mombasa and Nairobi helped to bolster this recovery. The rise in tourism revenues had a positive spillover effect on other sectors such as transport, retail, and food services.

However, the country’s reliance on global markets for both exports and tourism means that it remains vulnerable to external shocks. Any disruptions in global demand for horticultural products or a slowdown in international travel could adversely affect Kenya’s economy. As such, continued efforts to diversify Kenya’s export markets and promote domestic tourism will be crucial for mitigating these risks.

Implications

Kenya’s global trade and tourism sectors provided vital support to the economy in Q1 2024, but the country remains exposed to external risks such as fluctuating global commodity prices and geopolitical instability. The ongoing recovery in tourism and the robust performance of agricultural exports are positive signs, but greater diversification is necessary to insulate Kenya’s economy from potential shocks in international markets.

Conclusion

Kenya’s economic performance in Q1 2024 highlights a nation navigating the complexities of both domestic and global economic conditions. Agriculture and services were the key drivers of growth, providing a solid foundation for the economy. The easing of inflation offered some relief to consumers, while exports and tourism helped stabilize the country’s foreign exchange reserves.

However, challenges remain. The industrial sector continues to underperform, raising concerns about the long-term sustainability of Kenya’s growth model. Additionally, the rise in non-performing loans poses a risk to the financial sector, particularly if borrowing costs continue to increase as a result of the CBK’s monetary tightening.

Looking ahead, Kenya’s policymakers must focus on stimulating growth in lagging sectors such as manufacturing and construction, while also ensuring that inflation remains under control. At the same time, efforts to diversify Kenya’s trade partners and boost domestic production will be crucial in safeguarding the economy from external shocks. By leveraging the strengths of its agriculture, services, and tourism sectors, Kenya can continue on its path to sustainable, inclusive growth in 2024

Which sector do you believe will drive Kenya’s economic growth for the rest of 2024? Agriculture, Services, or Industry?